By Lilian Mukoche

Kakamega County, Kenya: Members of Savings and Credit Cooperative Societies (SACCOS) across the country have been imperfectly impacted by Covid-19.

In Kakamega County, it has emerged that many members are not able to pay their regular contributions.

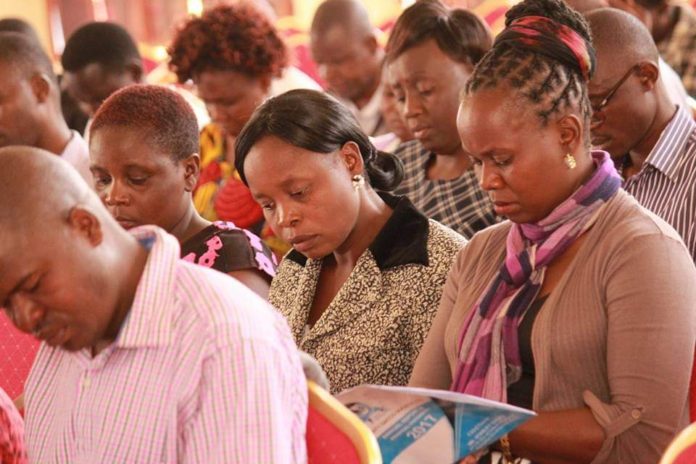

During a recent Annual Western Region supervisory/audit committee forum held in Kisumu, members who from different Sacco’s from the region cited various challenges they are facing during this pandemic period.

It was noted that a high default rate was being experienced leading to the low loan payment.

Loss of members and staff due to the virus which has resulted in Sacco’s to pay a lot in terms of compensation and decline in deposits was another challenge noted.

Also, during the engagement at the forum, participants had divided views on whether the Covid-19 pandemic is a threat or an opportunity. Some said the pandemic posed a health threat while others saw it as an opportunity for business.

Sacco’s aligned to county governments were pointed out as the most affected for due to delays by the national government to disburse money to the counties, the Sacco’s which their members work for the counties dint have money for operations.

The participants also noted that the pandemic had forced these entities to embrace technology, most Sacco’s now have online banking which makes it easier for members to apply and access loans although some are struggling to get there.

Dr. Jason Nganyi the Chair Board of Directors, Wevarsity Sacco ltd in Kakamega County said the organization has been faced with many challenges during this period of Covid-19 just like other financial institutions across the county.

Increased demand for loans, members making several visits to the office in need of services despite Covid-19 regulations, and a lot of agitation from members while seeking services was another challenge he cited.

“Covid-19 has made it impossible for us as members to have Annual General Meetings (AGM) which happens every year.” Agnes Amugamwa a member of one of the Cooperative Societies in Kakamega county says adding that this has made it impossible to transact any business to move the Sacco forward.

She says when she visits the Sacco for services, she gets the bank crowded since the entity is still working on online banking and this makes her not proceed with what she intended to do fearing that she might get Corona.

According to Nehemiah Oenga, Branch Manager Kenya Union of Savings and Credit Cooperatives (KUSCCO LTD) Kakamega branch, small Sacco’s are affected most and some have been closed down and this he says happens when parent companies discontinue operations.

He says uptake of loans has declined due to the inability of members and default rates have gone high due to Covid-19 arising from non-remittance or remittance taking the time.

He added that rising withdrawals too have been experienced due to members not being able to foot for their bills thus affecting the cooperative movement.

“The Covid-19 did not just affect businesses, but also the customers on a larger scale and the basic needs during and after the pandemic are health food housing and to an extent information,” He said adding that with the stay-at-home economy, the focus of any business should be knowledge of what your customers’ needs are.

Oenga noted how the pandemic has made customers and businesses very emotionally and financially delicate and as an organization, KUSCCO has engaged members in the cooperative movement and through the Cooperative Social Responsibility benefitted over 5000 households.

“As an advocacy organization, we advise Sacco’s to give short term loans during this period instead of allowing members to withdraw their membership.” Adding that KUSCCO has been sensitizing members on the government directives on keeping safe during this period of Covid-19 and training Sacco managers affected during the pandemic.

He further confirmed that the pandemic has forced many Sacco’s to embrace technology in order to continue with operations.