|

Getting your Trinity Audio player ready...

|

By Winnie Kamau

Pastoralists in Kenya are expected to enjoy from second Livestock Insurance Pay – outs from insurance companies.

In a move to compensate livestock keepers who bear the brunt of recurring drought, a consortium of insurance companies came together and were able to convince the Kenyan government to invest in a premium which they could pay out to herders in the drought stricken Counties.

As the adage goes ‘necessity is the mother of invention Kenya’s current drought situation necessity has become the mother of innovation’ through these insurance companies.

Using the satellite imagery technology, the forage condition is accessed and this triggers for a quick response from the Insurance companies.

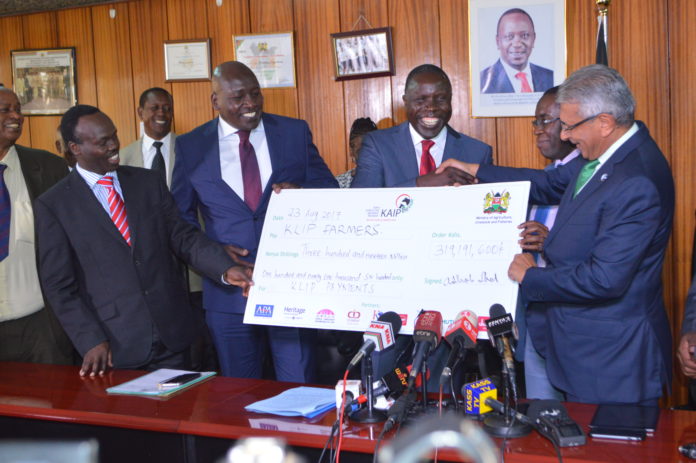

During a press briefing by Kenya’s Agriculture Cabinet Secretary (CS) Willy Bett was receiving 31.9 million dollars from the consortium of insurances who are making the last pay-out to pastoralists through the Kenya Livestock Insurance Program (KLIP).

The first ever program that was innovated by a consortium of insurance companies and partners saw the first premium paid at 5.8 million dollars. This premium was bought in July 2014 by the Kenyan government to insure 25,060 livestock units which saw a pay-out to 5,000 households from Wajir and Turkana counties.

Livestock Insurance Program KenyaVenngage Infographics

According to WASH sector group in Kenya pits the current number of herds of cattle in 10 Counties termed as Arid and semi arid areas at over 1 million livestock.

The second insurance contract package at the cost of 16.4 million dollars was bought in 2016 insuring 70,060 livestock in 6 counties of Wajir, Mandera, Tana River, Marsabit, Isiolo and Turkana. This premium saw the first payment of 21.5 million dollars paid out to 12,00 households during the first season March 2016.

During the long rains season beginning in October 2017 will see the 70,000 livestock insured in 6 counties triggered and insurance payment of 31.9 million U.S. dollars to 11,407 pastoralists after they were identified as severely affected by drought.

In explaining the new innovation that saw a consortium of over 9 Insurance companies led by APA Insurance, Charles Wambua head of Micro Insurance and Agribusiness said “This is the second pay-out to farmers during the second rainy season and will cushion the pastoralists”.

The innovation is modeled on satellite imaging using the vegetation index imaging that gives actual evidence where the pastoralists are affected. This real time data triggers for the payments to farmers with each pastoralist is given a minimum of 200 U.S dollars in each rainy season.

According to the Agriculture CS Bett “KLIP is intended to provide the much needed financial resources to the pastoral communities, through insurance, in the event a drought occurs. This is aimed at protecting the main assets of their livelihoods in livestock from death as a result of drought”.

The sustainability of this innovation was brought to the fore and the government said they were asking insurance companies to market the product to pastoralists and show the importance of insuring their livestock.

Dr. Andrew Tumur assured that the government had factored another 30 million U.S. dollars in the next 2017-2018 financial budget that will factor in 14 Counties currently affected by drought saying “We are also urging farmers we will match the insurance cover for every livestock they will insure in a one for one program with a maximum of 10 livestock per household”.

This One for One program is expected to encourage farmers to insure their livestock and this will be matched up by the government and is limited to 10 livestock per household. The current drought has hit over 2.6 million Kenyans in 14 Counties. CS Bett urged the County Governments to chip in saying “We request County Governments to set aside funds to complement National Government efforts in this noble initiative to cushion vulnerable members of the society from extreme shocks resulting from drought.”