|

Getting your Trinity Audio player ready...

|

By Juliet Akoth

Nairobi, Kenya: The Energy and Petroleum Regulatory Authority (EPRA) has released its Biannual Energy & Petroleum Statistics Report for the financial year 2024/2025, providing valuable insights into electricity access, consumption, and emerging energy trends across Kenya. The report covers the period between July 2024 and December 2024, highlighting significant developments in both electricity generation and consumer patterns.

According to the report, Kenya generated 7,222.37 Giga-Watt hours (GWh) of electrical energy, reflecting a 6.13% increase (417.09 GWh) compared to the first half of the previous financial year which stood at 6,805.28 GWh. This rise is attributed to the growing demand for electricity, driven by the expanding number of homes, businesses, and industries connecting to the national electricity grid. Speaking during the release of the report EPRA’s Director General Daniel Kiptoo emphasized the regulator’s commitment to providing access to electricity for all. “The energy and petroleum sector in Kenya keeps evolving and we have seen interesting advancements that keep promoting access, affordability, and sustainability,” he said.

Over this period, 194,654 new customers were connected to the grid, bringing the total number of connected customers to 9,852,423. Although this marks a decline from 260,257 new connections in the previous year, it still demonstrates steady progress in electricity access.

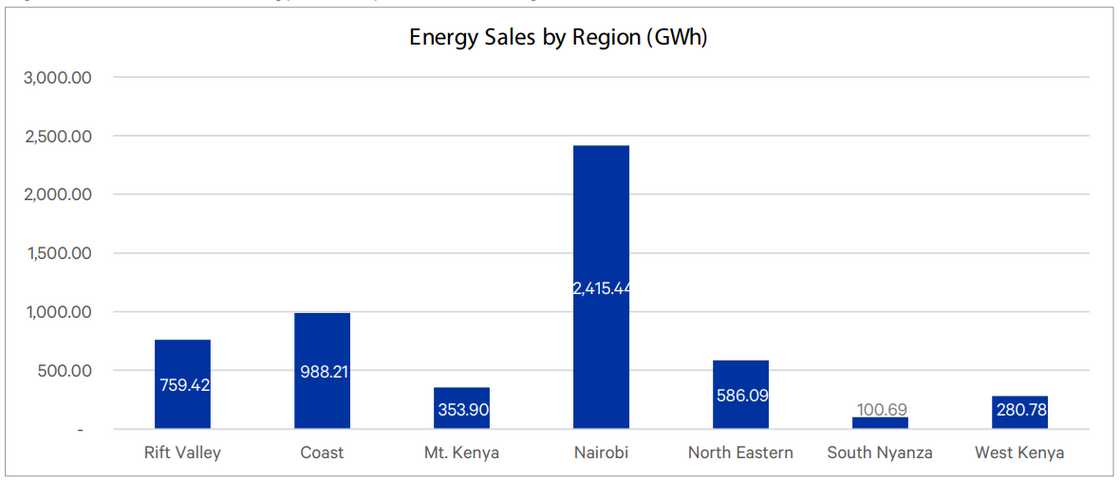

Kenya’s total energy consumption also rose, from 5,205.79 GWh to 5,484.54 GWh. When it comes to regions’ electricity consumption, the Nairobi region, which includes Nairobi, Kiambu, Kajiado, Machakos, and Makueni counties, remained the largest consumer, utilizing 2,415.44 GWh, or 44.04% of the country’s total consumption. This region’s high energy usage is driven by its concentration of industrial, commercial, and real estate activities. Following Nairobi, the Coast region consumed 988.21 GWh (18.02% of total consumption), while the Rift Valley region ranked third with 759.42 GWh (13.85%).

North-Eastern which clusters Garissa, Wajir, Mandera, Marsabit, Kitui, Thika, and parts of Machakos accounted for 10.69% (586.09GWh) while Mt. Kenya region accounted for 6.45% (353.90GWh) of the overall consumption. On the other hand, the West Kenya and South Nyanza regions recorded the lowest electricity consumption at 280.78 GWh and 110.69 GWh, accounting for 5.12% and 1.84% respectively.

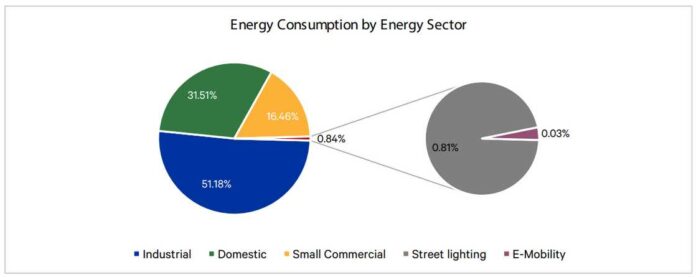

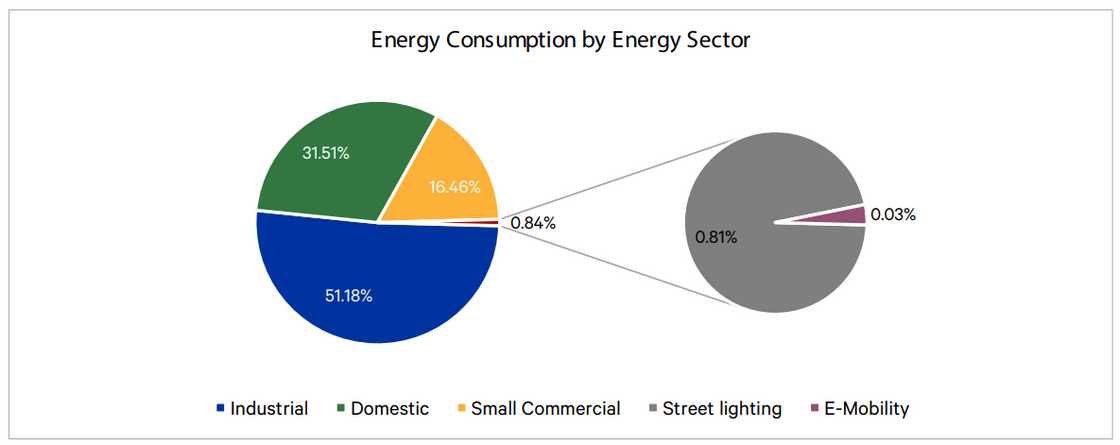

Industrial, Domestic, and Commercial Consumption

In terms of energy consumption by sector, industrial consumers (including factories, railway stations, ports, and public infrastructure) accounted for 51.18% of total energy use, consuming 2,807.10 GWh, a 101 GWh increase from the previous year. The CI1 tariff band, which includes industries using over 15,000 kilo-watt hours/month, recorded the highest electricity consumption at 924.11 GWh.

Domestic consumers were the second-largest category, consuming 1,728.19 GWh (31.51% of total consumption), up from 1,599.33 GWh in the previous year. Small commercial enterprises consumed 902.94 GWh, or 16.46% of total energy use, showing an increase from 843.04 GWh last year. Meanwhile, street lighting saw a slight decline in energy use, dropping by 12 GWh to 44.48 GWh, which represents 0.81% of total consumption.

The electric mobility sector, which includes electric vehicles and motorcycles, showed impressive growth. Consumption in this category surged from 0.32 GWh to 1.81 GWh, reflecting a 480.65% increase compared to the same period in the previous financial year. This growth is linked to government incentives such as the introduction of a special tariff for electric vehicles, reduced excise duty, and VAT exemptions on fully electric cars.

Emerging Energy Trends

Kenya is witnessing significant developments in renewable energy and sustainable transportation. One of the key emerging trends in the report is the adoption of electric mobility as part of Kenya’s strategy to decarbonize the transport sector. The government has launched various policies to support electric mobility, including a target for 5% of electric vehicle imports annually, and initiatives to promote electric motorcycle manufacturing. A special tariff for electric mobility, introduced in April 2023, has also helped accelerate adoption. As of December 2024, the number of registered electric vehicles had grown by 41.06%, reaching 5,294 units.

Additionally, green hydrogen is emerging as a promising solution to decarbonize the transport, agriculture, and energy sectors. Kenya’s Green Hydrogen Strategy and Roadmap, launched in September 2023, aims to utilize the country’s renewable energy resources to produce green hydrogen. The government is targeting $1 billion in direct investments by 2030, along with the creation of 25,000 jobs and the reduction of 250,000 tonnes of CO2 emissions annually.

Solar and Autogas Growth

The demand for solar energy is also rising, particularly among commercial and industrial consumers. Solar Photovoltaic (PV) systems now account for 47.21% of the country’s total generation capacity, with 271.3 MW of installed capacity. The regulator is supporting this growth by streamlining licensing processes and promoting favorable policies for solar investment. Moreover, autogas, powered by Liquified Petroleum Gas (LPG), continues to grow according to the report, supported by government incentives such as tax exemptions. In the review period, the EPRA issued 10 autogas construction permits and proposed amendments to improve safety standards in the sector.

The EPRA report underscores Kenya’s commitment to increasing energy access, promoting sustainability, and expanding renewable energy sources. The push for green hydrogen and solar energy demonstrates continued efforts to meet growing energy demands while advancing towards a low-carbon future.