By Winnie Kamau

Chief Executives and Managers of 5 Banks in Kenya set to be charged following an investigation by the Central Bank of Kenya (CBK) on the illegal transactions linked to the 9.1 Billion Shillings lost from the National Youth Service (NYS) funds.

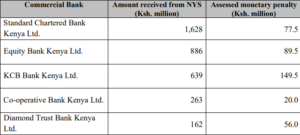

CBK in its Press release sent to media houses noted “The investigations of the illegal NYS funds was prioritized on the top 5 banks that handled the largest flows including Standard Chartered Bank of Kenya, Equity Bank Kenya Ltd, KCB Bank Kenya Ltd, Cooperative Bank of Kenya Ltd and Diamond Trust Bank Kenya Ltd” The statement read.

CBK says its investigations were examining the NYS-related bank accounts and transactions, and in each instance assess the bank’s compliance with the requirements of Kenya’s Anti-Money Laundering/Combating Financing of Terrorism (AML/CFT) laws and regulations.

“The banks are being faulted for failure to report large cash transactions, failure to undertake adequate customer due diligence, lack of supporting documentation for large transactions, and lapses in the reporting of Suspicious Transaction Reports (STRs) to the Financial Reporting Centre (FRC)” This were the findings of the regulator.

Documents received in May by the Public Accounts Committee (PAC) indicated that the NYS dealt with more than 30 banks or more than 90% of Kenya’s 41 banks.

From the reports by the Auditor General indicated that manipulation of the government’s financial management software, outright forgery, and neglect of duty enabled the theft of Sh1.6 billion between 2014 and 2015.

“The NYS cash was illegally moved through commercial banks into individual’s pockets and ultimately used to buy personal assets, with withdrawals of Sh100 million being made per day by a single borrower” Auditor General Report.

The Financial Reporting Centre (FRC) reckons that 15 raised 42 alerts over suspicious transactions relating to the Sh1.6 billion that was stolen through fictitious tenders.

The FRC, the state agency that tracks proceeds of crime, reckons that other agencies like anti-graft body and Directorate of Criminal Investigations (DCI) were slow to act on its alerts, enabling the theft of nearly Ksh2 billion.

Financial institutions are required to report all transactions above Ksh1 million ($10,000) to the FRC, but most do not. Of the 42 alerts of suspicious transactions, the FRC prepared and disseminated 19 financial intelligence reports for the Ethics and Anti-Corruption Commission (EACC) and DCI for action.

CBK in outlining its penalties said it had assessed monetary penalties for each of the five banks in accordance with the extent of the violations that were identified and pursuant to CBK’s powers under the Banking Act and the Central Bank of Kenya Act.

Those penalized are KCB Group (Sh149.5 million), Equity Bank (Sh89.5 million), Standard Chartered Bank-Kenya (ShSh77.5 million), Diamond Trust Bank (Sh56 million) and Co-operative Bank of Kenya (Sh20 million).

The total amount received by the banks were 2.1 billion Kshs and the penalties imposed totals to 392 Million Kshs an 18% of the amount that was received by the banks.

CBK confirmed they had discussed the detailed findings with Boards of Directors and Senior Management of each of the banks and the each had expressed their strong commitment to being fully compliant on all aspects of the law, and addressing the identified lapses through time-bound Action Plans.

The Banks have 14 days to comply while the Files now are on the desk of the Prosecutor and Investigator awaiting further action.